ADB’s support for its developing member countries (DMCs) in 2022 focused on these broad areas: tackling crosscutting and global challenges such as climate change and food insecurity; enhancing economy-wide resilience and strengthening the enabling environment for recovery and growth; and rapidly responding to crises in several DMCs. ADB’s long-term partnerships played a major role in mobilizing financial resources and specialist knowledge for these interventions.

Check out the dashboard, maps, and tables below to explore the details of 2022’s sovereign and nonsovereign cofinancing.

2022 Commitments

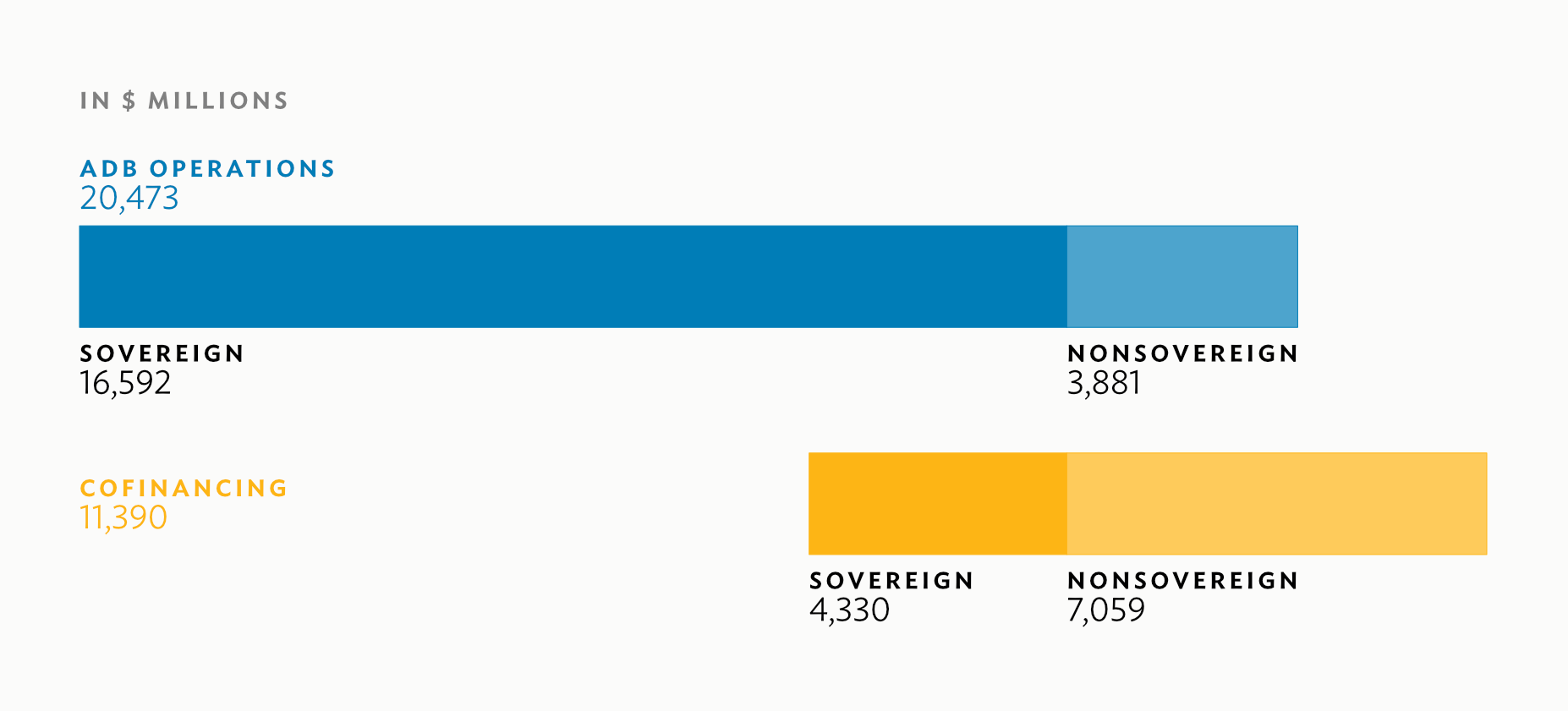

Commitments from ADB’s resources—loans, grants, guarantees, technical assistance (TA), and equity investments—totaled $20.5 billion for 141 projects, 285 TA operations, and over 10,000 transactions under private sector programs. ADB mobilized $11.4 billion from its financing partners, supporting 75 projects, 87 TAs, 3 transaction advisory services, and over 10,000 transactions under private sector programs.

Sovereign cofinancing is third-party funding that contributes to ADB outcomes. All ADB projects and technical assistance can be cofinanced, with details varying in terms of

- how much control and responsibility ADB has for the project (i.e., full administration, partial administration, or no administration)

- what terms apply (i.e., loans or grants)

- whether it is for a specific project (project-specific cofinancing) or theme (trust fund activities)

Nonsovereign cofinancing can be from both private and public institutions. The funds are usually sourced from financial markets and priced at commercial terms. It can be categorized by

- tenor or duration of the engagement, e.g., short-term (less than 1 year) and long-term products

- product, which includes B loans, guarantees, parallel loans and bonds, risk transfers, transaction advisory services, and revolving programs such as the Trade and Supply Chain Finance Program and the Microfinance Program.

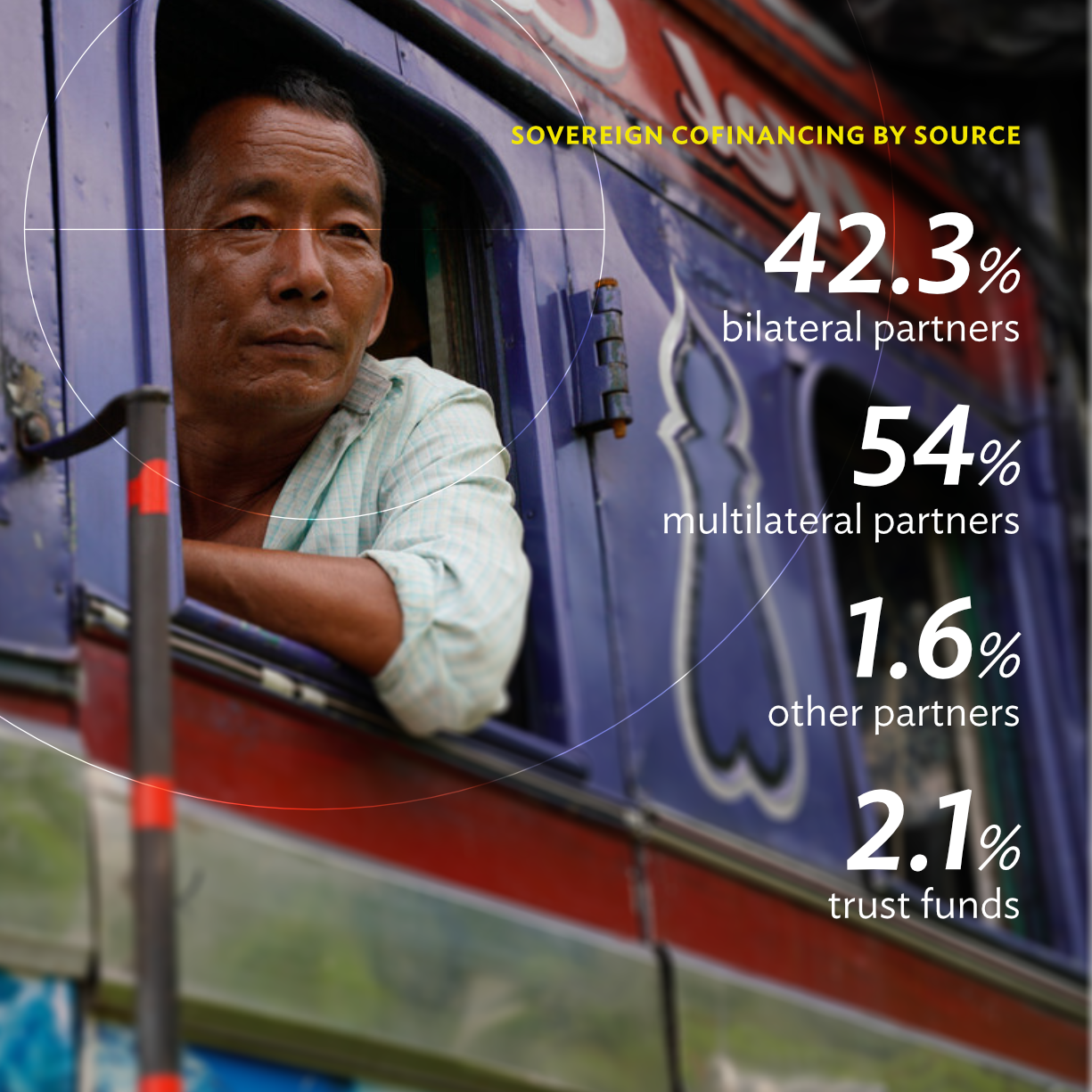

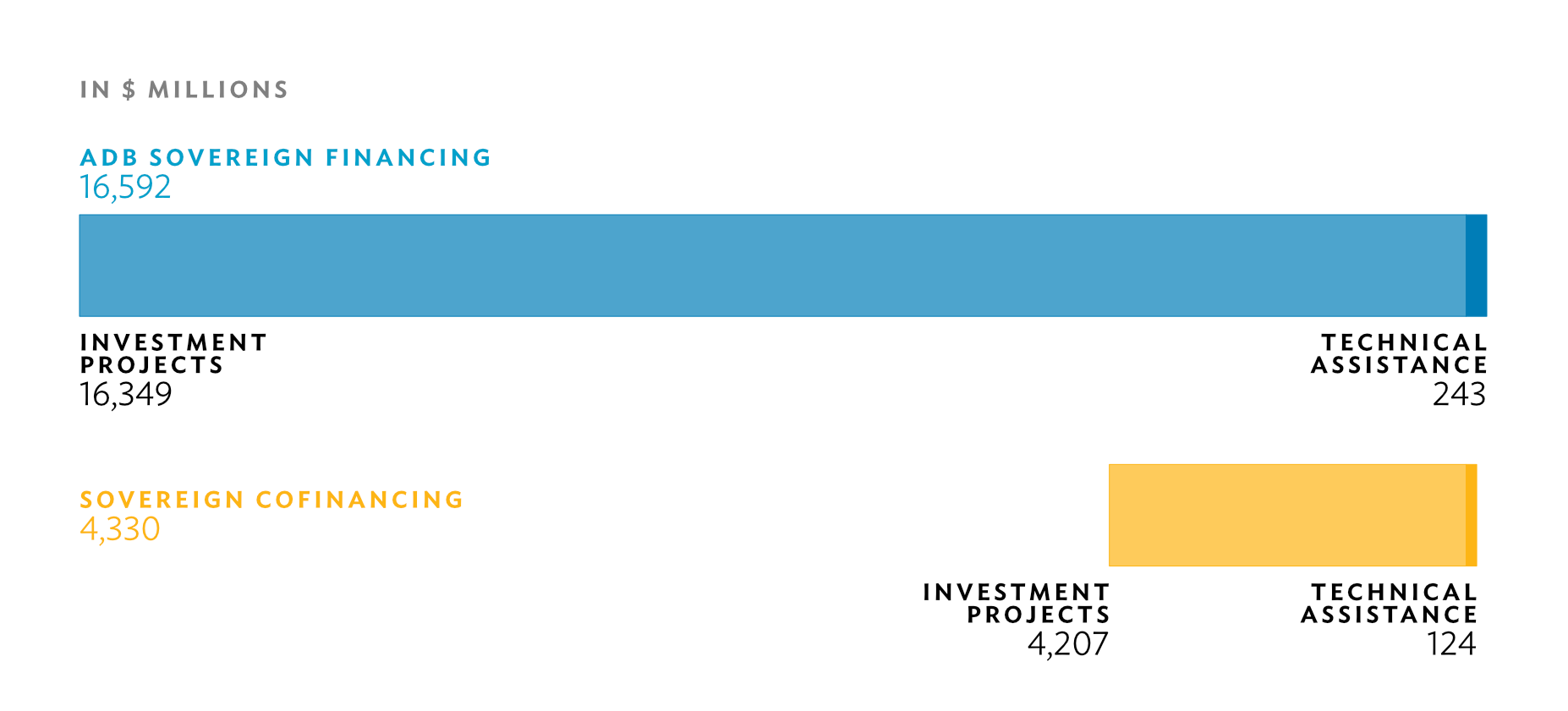

Sovereign cofinancing for 2022 totaled $4.3 billion, declining by 13% from 2021’s total of $5 billion. This change is mainly due to cofinancing approval for several projects slipping to 2023 to ensure project readiness. The ratio of sovereign cofinancing against total ADB sovereign operations is 26%, just 1% lower than 2021’s 27%.

A total of 124 sovereign projects and TAs benefited from these external resources, broken down as follows:

- 24 projects with loan cofinancing of $4 billion

- 23 projects with grant cofinancing of $234 million

- 82 technical assistance with grant cofinancing of $124 million

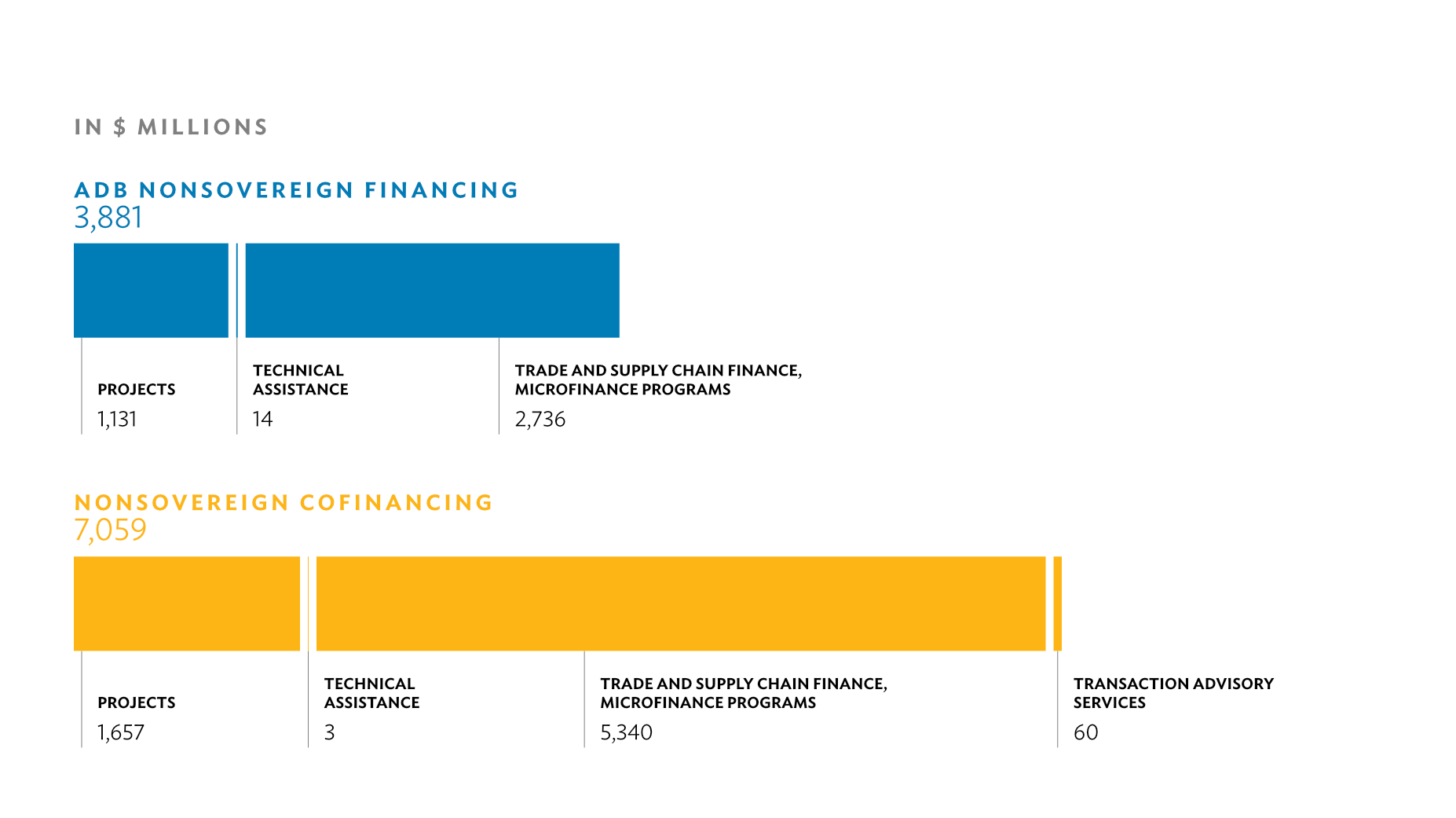

Nonsovereign cofinancing for 2022 totaled $7.1 billion, representing an 11% decline from 2021’s total of $8 billion. Despite this decline, it is worth noting that the 2022 volume is still higher than prepandemic levels. The long-term nonsovereign cofinancing, which serves as the basis for computing the nonsovereign cofinancing ratio, * declined to $1.8 billion from $2.2 billion in 2021, resulting in a lower ratio of 1.8 compared to the 2.2 ratio of 2021. The decline can be attributed to a decrease in resources mobilized by transaction advisory services.

A total of 41 projects, programs, and TAs benefited from these resources, broken down as follows:

- 30 projects with cofinancing of $1.7 billion

- 5 technical assistance with cofinancing of $3 million

- 3 transaction advisory services with cofinancing of $60 million

- 3 programs (Trade and Supply Chain Finance Program and Microfinance Program), with cofinancing of $5.3 billion supporting 10,231 transactions

Climate Change

ADB has placed combating climate change and its consequences at the top of its development agenda. In 2018, the bank committed to providing a cumulative $80 billion of its own resources to climate action for its developing member countries from 2019 to 2030. In 2022, ADB raised this ambition to $100 billion.

From its own resources, ADB committed $6.7 billion in climate financing in 2022, bringing to $21 billion the cumulative financing for 2020–2022 and making headway toward its enhanced ambition of $100 billion in cumulative climate financing.

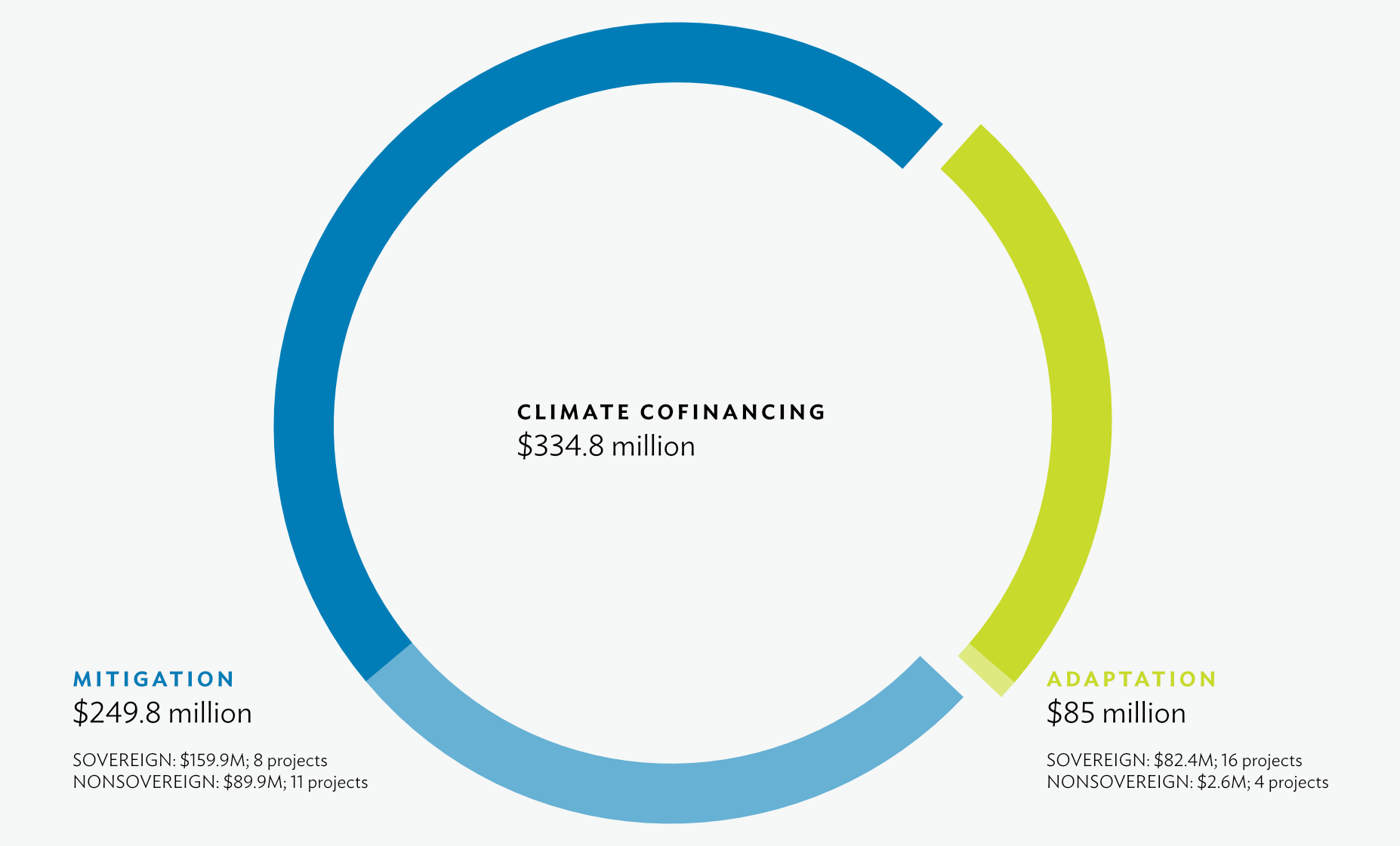

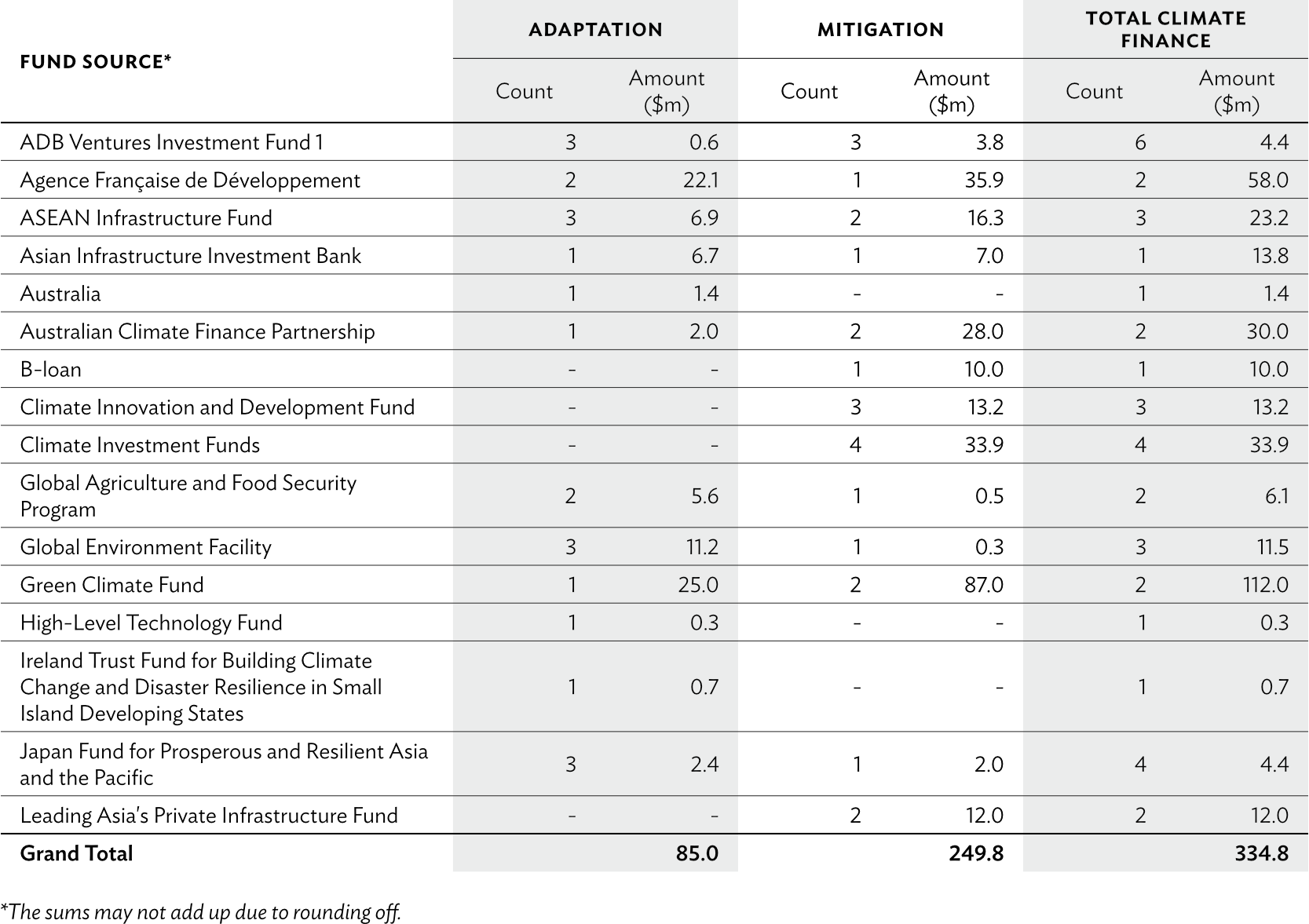

From partners, ADB mobilized $242.3 million for 17 sovereign projects and $92.5 million for 14 nonsovereign projects. Some projects address both adaptation and mitigation concerns—8 sovereign and 1 nonsovereign projects.

The partners with the highest commitments for climate financing in sovereign and nonsovereign operations are the (i) Green Climate Fund, which accounted for 33% of total climate cofinancing; (ii) Agence Française de Développement with 17%; (iii) Climate Investment Funds with 10%; and (iv) Australian Climate Finance Partnership with 9% share.

The partners that supported climate-related projects are as follows:

ADB’s Trade and Supply Chain Finance Program (TSCFP) also financed 238 green transactions valued at $321 million—where $214 million is cofinanced—including solar and wind energy deals. Among the green transactions were the production of electric vehicles in partnership with one of TSCFP’s partner banks, PT Bank HSBC Indonesia, and the financing for a leading exporter of frozen and processed seafood products (e.g., shrimp, crab, and fish) in Indonesia.

Food Security

Food insecurity is one of the many consequences of climate change. The heat waves, droughts, or heavy rainfall influenced by global warming have already disrupted agricultural processes. Roughly 424.5 million people in the region faced hunger in 2021, nearly 48 million more people than in 2020. With the Russian invasion of Ukraine, supply chain disruptions, and the continued economic fallout of the COVID-19 pandemic pushing food prices to all-time highs, this number is expected to increase further.

Responding to the region-wide food crisis, ADB announced in 2022 a $14 billion program over 2022–2025 to provide immediate food relief and improve long-term food security in Asia and the Pacific. In 2022, ADB committed nearly $3.7 billion from its own resources, including essential food assistance for those in need in Afghanistan* (through the United Nations), Pakistan, and Sri Lanka.

The partners committed resources to 15 sovereign and nonsovereign projects and programs, covering livestock health and value chain improvement, food security and livelihood recovery, flood risk management, and more. The Asian Infrastructure Investment Bank and the Japan Fund for Prosperous and Resilient Asia and the Pacific each supported three projects and technical assistance. The Agence Française de Développement supported two, and the ASEAN Infrastructure Fund, Global Agriculture Food Security Program, High-Level Technology Fund, the Netherlands, and the World Bank each supported one.

Crisis Support

ADB and its partners provided immediate support to emerging and worsening crises in the region.

For sovereign operations, the partners committed just over $1.6 billion in cofinancing to bolster ADB’s operations worth $3.9 billion geared toward crisis response and support. The cofinancing supported sovereign projects that (i) responded to the food crisis in Sri Lanka, where the project provided poor and vulnerable people with direct financial support to compensate for the food price increase and supported livelihood development activities to counteract food shortages and income losses; (ii) helped Pakistan mitigate the adverse effects of the economic crises and enhance the resilience of poor and vulnerable groups to socioeconomic shocks; and (iii) boosted Mongolia’s efforts to deal with external shocks to its economy that resulted in rising fuel and food prices.

The Japan Fund for Prosperous and Resilient Asia and the Pacific provided grants to five projects—the Sri Lanka project earlier mentioned; the Government of Bhutan’s COVID-19 vaccination program that provided safe, sustainable, and inclusive drinking water and irrigation services to about 100,000 people who suffer from water insecurity in the country; India’s COVID-19 infection and prevention control project in flood-prone urban areas; and Fiji’s efforts to increase its readiness to safely reopen to tourists and rebuild the country’s economy following the COVID-19 pandemic. In Sri Lanka, the Trade and Supply Chain Finance Program (TSCFP) also played a strong role in maintaining trade during the country’s economic crisis. To ensure continued imports of essential goods such as fertilizers and medical supplies, ADB used the TSCFP to execute transactions under its Emergency Trade Finance Facility. The cofinanced projects that helped developing member countries weather various crises are as follows:

Recovery and Resilience

In 2022, ADB promoted economy-wide resilience through investments in social sectors, infrastructure, and natural resources. It committed $798.8 million from its own resources to the education sector, addressing issues such as learning losses during the pandemic. It also provided $822.8 million to the health sector, focusing on initiatives to expand access to affordable services. In addition, ADB continued providing strong support for quality infrastructure, with investments in transport ($4.3 billion), energy ($1.4 billion), and water and other urban services ($1.1 billion). Meanwhile, the bank invested $2.2 billion to enhance the productivity and resilience of the region’s agriculture and natural resources sectors. ADB also strengthened the enabling environment for recovery and growth with $3.7 billion commitments for institutional reforms, capacity building, and strengthened public service delivery in developing member countries. The bank also provided $6 billion to support growth in finance, industry, and other economic sectors.

From the $4.3 billion sovereign cofinancing in 2022, the public sector management sector received the most commitments at $2.1 billion, covering 22 sovereign projects and representing 49% of total sovereign cofinancing for the year. It also received 47% ($101.3 million) of total grant cofinancing ($216.3 million) and more than half (52%) of the total grant of the top five bilateral partners ($190.6 million). From among the contributors to this sector, the Asian Infrastructure Investment Bank (AIIB) committed $900 million, Japan International Cooperation Agency committed $699.3 million, and the World Bank committed $319 million. The transport and energy sectors received the next highest commitments at $780.6 million and $664.5 million, respectively. Of the eight partners who committed resources for the transport sector, the combined share of the AIIB and the New Development Bank totaled 90%. For the energy sector, 14 partners committed resources, with KfW ($292 million), Agence Française de Développement ($171.7 million), and Australia ($73.3 million) committing the most.

From the $7.1 billion nonsovereign cofinancing, 88% or $6.2 billion focused on the finance sector. The energy sector followed with a 6% share of the commitments.

The breakdown of sovereign commitments per partner per sector is in the dashboard.

Strategy 2030 Operational Priorities

ADB continued pursuing its vision of a prosperous, inclusive, resilient, and sustainable Asia and the Pacific in 2022, focusing on enabling its developing member countries to absorb, manage, recover from, and flourish despite the multiple shocks of the year.

Each of ADB’s operations typically contributes to one or more operational priorities of Strategy 2030.

In 2022, the sovereign and nonsovereign operations tagged against the operational priorities are as follows:

For sovereign projects, five partners emerge as having supported the most sovereign projects for multiple operational priorities. These are the Japan Fund for Prosperous and Resilient Asia and the Pacific, the Republic of Korea e-Asia and Knowledge Partnership Fund, Australia, the High-Level Technology Fund, and the Global Environment Facility.

Sovereign Cofinancing Distribution

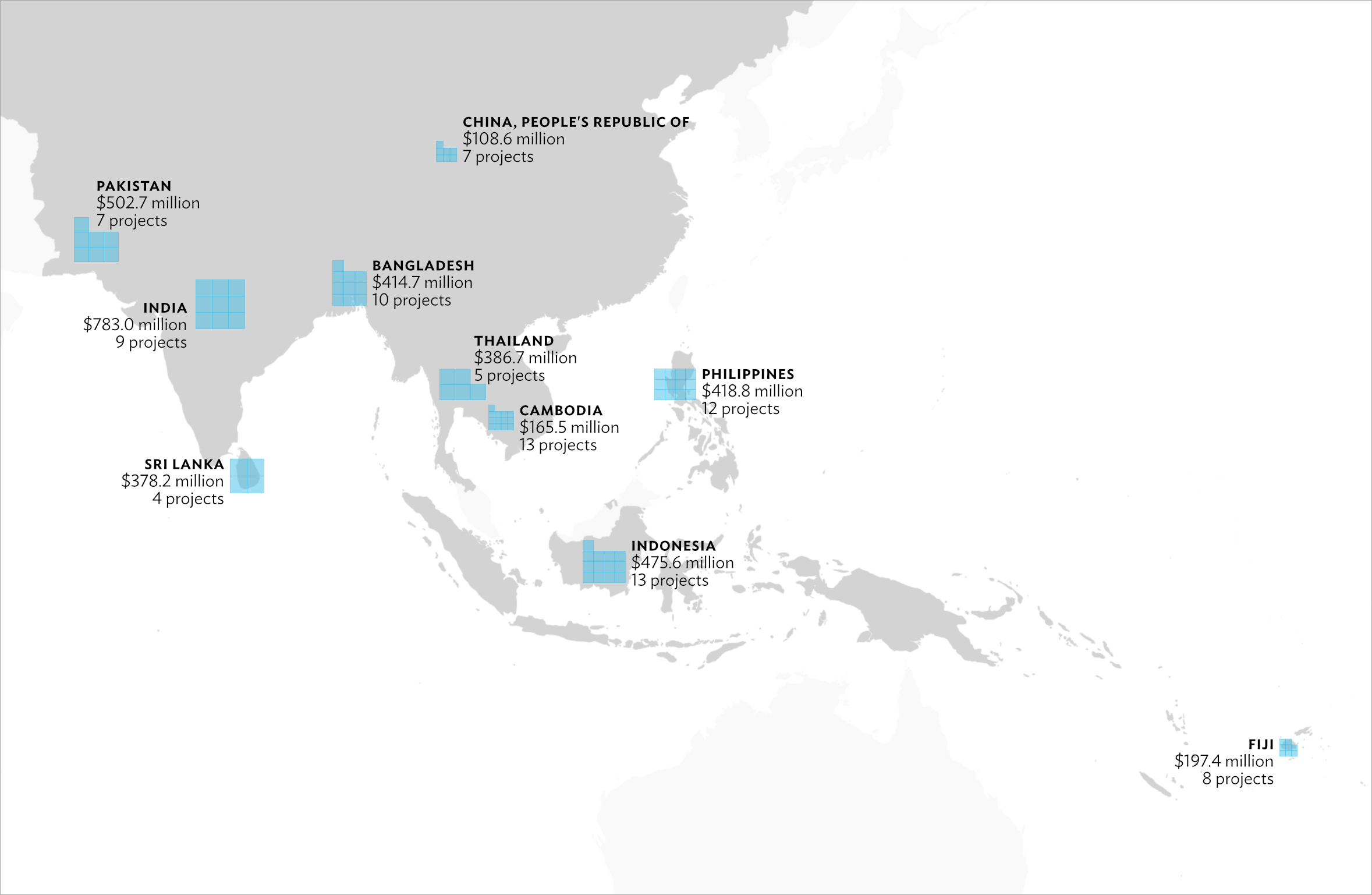

As in previous years, the South Asia Department mobilized the highest volume of sovereign cofinancing among ADB’s regional departments, reaching over $1.6 billion spread across 26 projects and technical assistance. This volume, however, spells a roughly 30% decline from 2021’s cofinancing of $2.3 billion. India’s Chennai Metro Rail Investment Project received the highest cofinancing, with loans from the Asian Infrastructure Investment Bank and the New Development Bank at $356.7 million and $347 million, respectively. The World Bank supported Sri Lanka’s food security and livelihood recovery emergency assistance project with a $275 million loan. Among ADB’s regional departments, the Southeast Asia Department (SERD) is the only one that increased its sovereign cofinancing commitment, by a remarkable 30%, compared to the commitments in 2021. SERD’s sovereign cofinancing for 2022 totaled roughly $1.5 billion for 37 projects and technical assistance (TA). Around 66% of SERD’s cofinancing supported COVID-19 interventions focusing on response, recovery, and resilience building. The partners with the biggest commitments were KfW for Indonesia’s sustainable and Inclusive Energy Program, Agence Française de Développement for the Philippines’ Climate Change Action Program, and Japan International Cooperation Agency (JICA) for the COVID-19 Active Response and Expenditure Support Program in Thailand.

The Central and West Asia Regional Department had $643.2 million commitments from partners in 2022, supporting 19 projects and TA. Pakistan’s Building Resilience with Active Countercyclical Expenditures Program, which helped Pakistan weather the impacts of devastating floods and other shocks, had the biggest loan commitment from the AIIB at $500 million. The Republic of Korea e-Asia and Knowledge Partnership Fund and the People’s Republic of China Poverty Reduction and Regional Cooperation Fund each supported six projects focusing on balanced and sustainable urban operations and water, sanitation, and hygiene.

The Pacific Regional Department (PARD) mobilized $373.8 million in partner resources in 2022. Of the total grant cofinancing ($216.33 million), 52% ($114.05 million) went to PARD, a significant increase from the $59.4 million commitment in 2021. The highest grant from bilateral partners was for Fiji’s Sustainable and Resilient Recovery Program, a policy-based loan supported by a $126.6 million loan from JICA and the AIIB and a $61.7 million grant from the governments of Australia and New Zealand. Among bilateral partners, Australia’s grant increased sixfold, from $17.9 million in 2021 to $109.62 million in 2022, comprising its support for the Fiji project mentioned above, Papua New Guinea’s Power Sector Development Project, and Samoa’s Strengthening Macroeconomic Resilience Program.

Partners committed $216 million to projects by the East Asia Regional Department, the bulk of which is for two loans. The Green Climate Fund provided $100 million in additional financing to the People’s Republic of China’s Shandong Green Development Fund Project, and the AIIB committed another $100 million to Mongolia’s Weathering Exogenous Shocks Program.

In 2022, Cambodia and Indonesia had the most cofinanced projects and TA at 13 each. The Philippines followed with 12, Bangladesh had 10, and India had 9. In terms of the volume of cofinancing though, India takes the lead, having mobilized $783 million for its projects or 18% of total sovereign cofinancing. Pakistan comes in second with $502.7 million (125%), and Indonesia comes third with $475.6 million (11%).