The Asia-Pacific Climate Finance Fund or ACliFF aims to support the development and implementation of financial risk management products that can help unlock capital for climate investments and improve resilience to the impact of climate change. The fund supports these as part of existing and future climate-related projects that would benefit from the provision of such products. It focuses on financial risk management products proven elsewhere but not yet widely commercially available in ADB’s developing member countries.

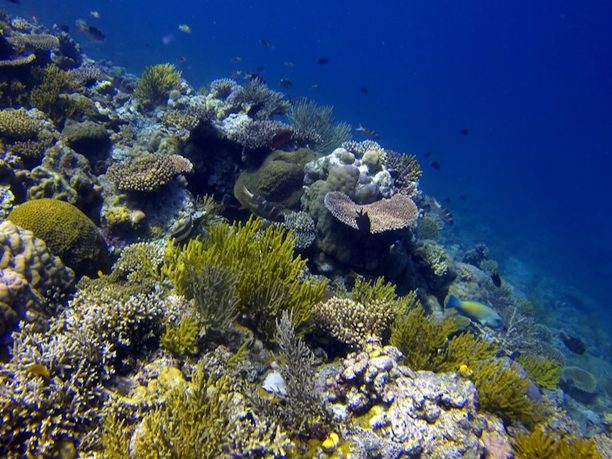

ACliFF supported promoting a sustainable blue economy and climate insurance in the region in 2022. It extended support for ADB’s Blue Bond Incubator launched during the seventh Our Ocean Conference in Palau. The world’s first blue bond incubator helps finance ocean-related projects that mitigate the impact of and protect the livelihoods of hundreds of millions of people in Asia and the Pacific from climate change. ACliFF also supported the development of climate risk financing and insurance solutions for the protection of coral reefs in Southeast Asia, as well as climate-smart insurance for micro, small, and medium-sized enterprises in the Philippines.

News

ADB approved a $3.8 million technical assistance to support the restoration, conservation, and management of coral reefs in four countries in Southeast Asia and the Pacific. The project, financed by the Asia-Pacific Climate Finance Fund and the Global Environment Facility will develop climate risk financing and insurance solutions to protect coral reef ecosystems in Fiji, Indonesia, the Philippines, and Solomon Islands.

The world’s first Blue Bond Incubator was launched by ADB during the 7th Our Ocean Conference in Palau on 13 April 2022, to support ocean-related projects in Asia and the Pacific. Ocean investments are vital for combating the impact of climate change and protecting the livelihoods of hundreds of millions of people. The Blue Bond Incubator is supported by ADB’s Asia-Pacific Climate Finance Fund and will help scale up sovereign and corporate blue bond issuances for critical ocean investment.