As businesses across Asia and the Pacific struggled with challenges such as inflation and trade disruptions resulting from the Russian invasion of Ukraine, the COVID-19 pandemic, and climate change, ADB and its partners helped the private sector in the region build resilience by catalyzing, structuring, and providing innovative financing to privately held and state-owned enterprises.

Cofinancing in 2022

Nonsovereign operations (NSO) focus on projects that help promote investments in the region; are expected to have a significant development impact; and could lead to accelerated, sustainable, and inclusive growth. Nonsovereign cofinancing amplifies the impact of NSO by attracting financing from other parties. It facilitates investment, trade, and capital flows into developing member countries.

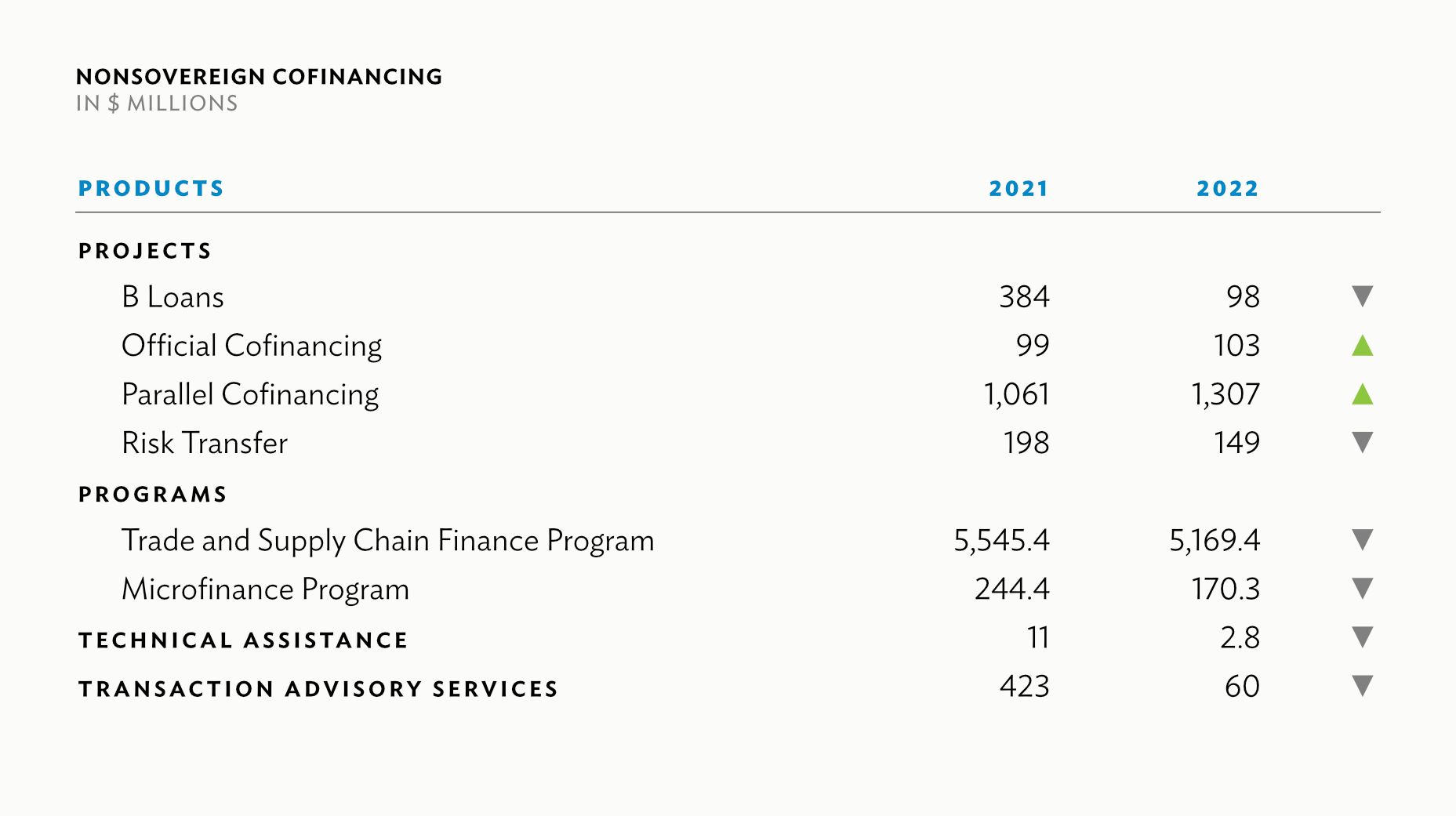

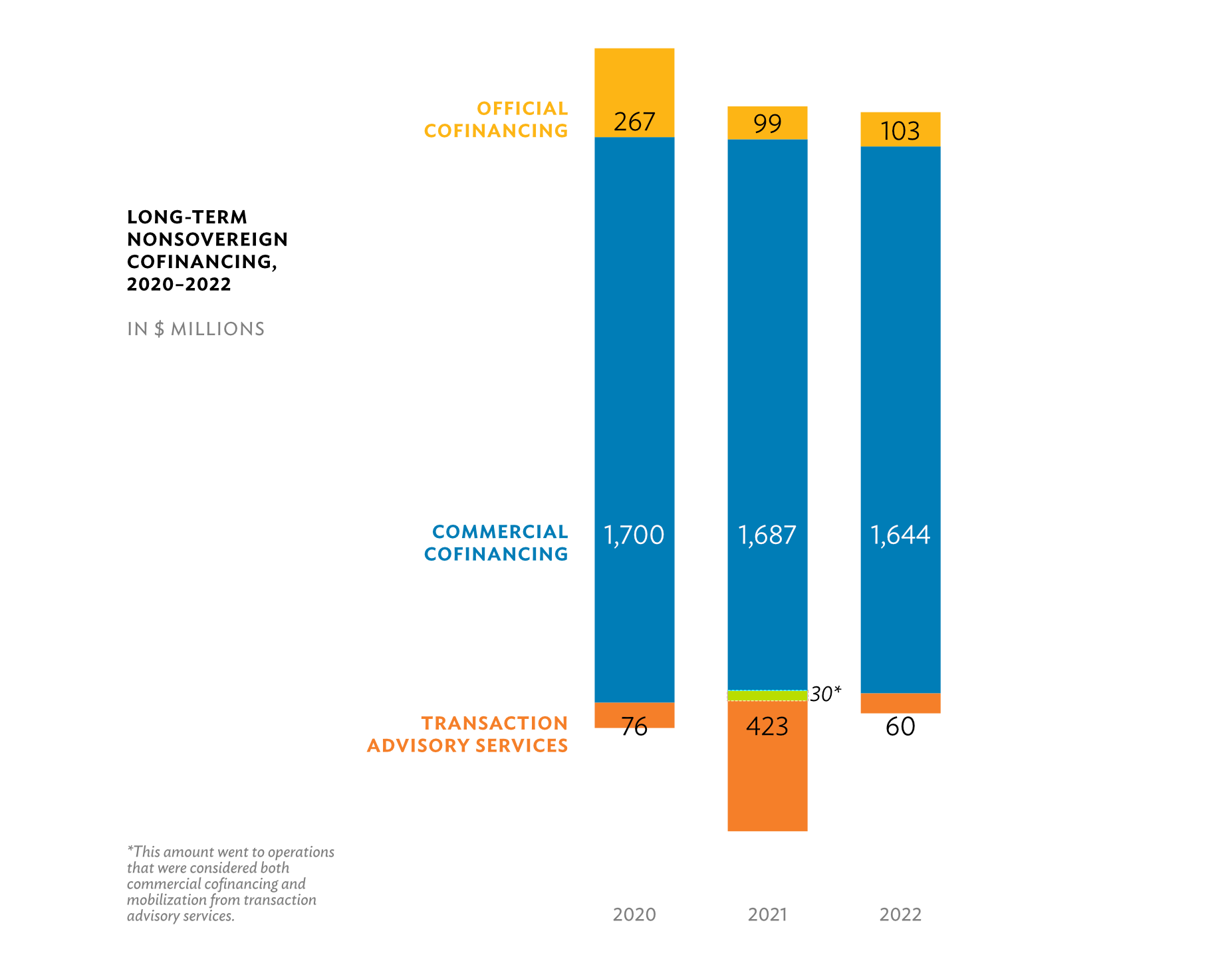

Cofinancing in 2022 for NSO amounted to $7.1 billion, an 11% decrease from 2021 due to the combined decrease in private sector programs and transaction advisory services. Despite this decline, it is worth noting that the cofinancing volume remains higher than what it was prior to COVID-19.

Project-related cofinancing—B loans, risk transfers, parallel cofinancing, and official cofinancing—totaled $1.7 billion, while the Trade and Supply Chain Finance Program generated the most cofinancing, reaching $5.2 billion in 2022. The Microfinance Program reached $170.3 million. Technical assistance cofinancing amounted to $2.8 million, and the transaction advisory services for public–private partnerships amounted to $60 million.

ADB’s Strategy 2030 sets for NSO a target ratio of $2.5 cofinancing for every $1 of ordinary capital resources deployed. In 2022, project cofinancing reached $1.7 billion, generated through official and commercial cofinancing and resulting in a 1.8 cofinancing ratio.

Projects

Financing projects in the developing member countries (DMCs) through NSO comprise the provision of any loan, guarantee, equity investment, risk transfers, parallel cofinancing, and official cofinancing to privately held, state-owned, or subsovereign entities. In 2022, ADB’s project nonsovereign cofinancing totaled $1.7 billion.

B Loans

B loans are loans funded by commercial banks and other eligible financial institutions, with ADB as a lender. Participants benefit from ADB’s status as a multilateral development institution, including its relations with governments and experience in a certain sector. ADB, as mandated lead arranger and book runner, mobilized an $85 million B Loan and $60 million parallel loans for Far East Horizon Limited (FEH) in 2022. As an additional financing package, these loans are an extension of ADB’s direct $150 million loan provided to FEH in June 2019 under the Healthcare Finance in Underdeveloped Provinces Project in the People’s Republic of China (PRC), which demonstrates ADB’s continuing support to the provision of lease finance for public hospitals in the 12 least-developed provinces of the PRC. As of end June 2021, FEH had a pipeline of about $600 million in unfinanced eligible lease contracts. The additional financing package substantially addressed this funding requirement. Eligible lease financing under the project is used by public hospitals to procure modern medical equipment, primarily serving the population in surrounding rural areas.

Guarantees

To catalyze capital flows into and within its DMCs, ADB extends guarantees for eligible projects, which enable financing partners to transfer to ADB certain risks that they cannot easily absorb or manage on their own. These guarantees can be “partial credit guarantees,” where ADB provides comprehensive cover to cofinanciers against commercial and political risks, and “partial risk guarantees,” with ADB covering just some of the risks associated with a loan. ADB’s guarantees support infrastructure projects, financial institutions, capital market investors, and trade financiers. They cover a wide variety of debt instruments. In 2022, the Uzbekistan: Zarafshan Wind Power Project was committed, providing long-term financing for a 500-megawatt grid-connected wind power project. ADB and Shamol Zarafshan Energy Foreign Enterprise Limited Liability Company, a subsidiary of Abu Dhabi Future Energy Company Private Joint Stock Company (Masdar), signed a $52 million loan agreement to finance Uzbekistan’s first wind power plant and the largest yet developed in Central Asia. The financing, being nonsovereign support for the first wind project in Uzbekistan by ADB, represents a meaningful engagement by ADB to mitigate climate change.

STORY

The Uzbekistan Zarafshan Wind Power Project provides financing for a 500-megawatt grid-connected wind power project. It will expand Uzbekistan’s generation capacity using renewable energy and improve domestic energy sources.

Read moreOfficial Cofinancing

Official cofinancing, where ADB cofinances with bilateral and multilateral development assistance partners, totaled $102.7 million in 2022. One project example is the India: GreenCell Electric Bus Financing Project. ADB signed a $39 million financing package with GreenCell to develop 255 e-buses to serve 5 million people a year on 56 intercity routes in India and enhance the safety of passengers, especially women. The package includes official cofinancing of $19.5 million, comprising a $14 million concessional loan and $0.3 million grant from the Clean Technology Fund, structured to reduce the risk for senior lenders, and a $5.2 million grant from the Climate Innovation and Development Fund, designed to support a pilot on-site battery energy storage system at one of GreenCell’s bus depots and increase clean electricity supply.

Parallel Cofinancing

Parallel cofinancing is provided by third-party cofinanciers to a project alongside ADB. This can either be a parallel loan, a third-party loan in transactions that have ADB’s direct loan or equity participation, or a parallel equity, which is a third-party equity investment in a private equity fund or a transaction where ADB makes a direct investment. One of the projects signed in 2022 involving parallel cofinancing is the Viet Nam: Hayat Women and Children Personal Hygiene Products Project. The project is constructing a manufacturing facility, purchasing equipment, and funding other capital expenditures in Viet Nam to produce baby diapers, wet wipes, and women’s hygiene pads. The project is expected to increase consumer choices and improve the affordability of baby diapers, wet wipes, and women’s hygiene pads in Malaysia, Thailand, and Viet Nam.

Risk Transfer

A risk transfer is an agreement between ADB and a financing partner under which—through insurance policies, risk participation agreements, or other similar contracts—the partner assumes a portion or all of ADB’s risk of loss. In 2022, ADB signed an agreement with five leading global insurers, which will mobilize up to $1 billion of cofinancing capacity to support lending to financial institutions in Asia and the Pacific. The Master Framework Program for Financial Institutions will allow ADB to increase its lending to both commercial banks and nonbank financial institutions in the region through the use of credit insurance. ADB had signed an initial 3-year partnership with Tokio Marine Group (Tokio Marine & Nichido Fire Insurance Co. Ltd, and Tokio Marine HCC), AXA XL, Chubb, Liberty Specialty Markets, and Allianz Trade.

Environment-Friendly Motorized Vehicles in Viet Nam

Viet Nam’s transport sector accounts for 18% of the country’s annual greenhouse gas emissions, and its decarbonization, through options like e-mobility, will directly impact the country’s ambition to achieve net zero emissions by 2050.

ADB mobilized a $135 million—where $115 million is cofinanced— financing package for VinFast Trading and Production Joint Stock Company (VinFast) for manufacturing Viet Nam’s first fully electric public transport bus fleet and first national electric vehicle charging network. The assistance will support Viet Nam’s efforts to achieve net zero greenhouse gas emissions and expand high-tech manufacturing industries.

Read more about this project.

Programs

Trade and Supply Chain Finance Program

Financing, together with effective risk mitigation, is now well recognized as a critical enabler of international trade. Since the private sector banks and other traditional sources of trade finance will not be able to significantly narrow that trade gap, the role of other providers, including multilateral institutions like ADB, is indispensable.

The Trade and Supply Chain Finance Program (TSCFP) uses its unique position at the nexus of private sector financing and public-good mandates to develop and deploy high-impact solutions to regional and global supply chains across Asia and the Pacific. The TSCFP has two broad streams of action: a core business delivering guarantees and loans for traditional trade and supply chain finance; and special projects that improve access to global trade and supply chains while addressing some of society’s most important environmental and social issues. Working alongside governments, industry leaders, regulators and other stakeholders, the TSCFP aims to transform trade for the 21st century and make trade and supply chains greener, more inclusive, resilient, transparent, and socially responsible.

In 2022, the TSCFP recorded over 10,000 transactions valued at $7.7 billion, with $5.2 billion in cofinancing. Of the $5.2 billion cofinancing, $4.9 billion was from trade finance products while $288 million was from supply chain finance products.

Under the TSCFP, the Digital Standards Initiative was initiated as a special project to drive the digitalization of global trade. It also led initiatives to improve gender equity and developed environmental and social management systems for partners throughout developing Asia and the Pacific.

Green Green Trade and Supply Chain Finance Program

In 2022, the TSCFP financed 238 green transactions valued at $321 million—where $214 million is cofinanced—including solar and wind energy deals. One of these green transactions was to finance the production of electric vehicles (EVs) in partnership with one of TSCFP’s partner banks. The partnership for EV manufacturing is the first of its kind for supply chain financing.

Another partnership was with PT Bank HSBC Indonesia to provide financing to a leading exporter of frozen and processed seafood products (e.g., shrimp, crab, and fish) in Indonesia. The company primarily exports to various seafood distributors in the United States, which, in turn, supply major retail chains and other buyers. The company has sustainability practices built into its operation and is a major player in ensuring food security.

Green Trade and Supply Chain Finance Program—Supporting Pakistan’s Trade and Supply Chains

A good demonstration of the strategic reach of ADB’s Trade and Supply Chain Finance Program (TSCFP) is to consider its operations in a single country, in this case, Pakistan. The program produces key results through its core business of trade finance and through a range of special projects designed to make trade and supply chains green, transparent, inclusive, and socially responsible.

In 2022, the TSCFP supported over 651 transactions valued at $2.4 billion in Pakistan, $1.7 billion of which was cofinanced by the private sector. Support from TSCFP’s core business is focused on Pakistan’s basic needs. About 90% of this support involved imports of energy, food, and agricultural products.

Pakistan is one of five countries taking part in a TSCFP pilot to address trade-based money laundering. The TSCFP has been working with regulators, industry groups, banks, and law-enforcement organizations to advance the use of trade-related data to detect crime. It has been working with Pakistan officials to strengthen the regulatory environment to scale supply chain finance, which will help close financing gaps for small and medium-sized companies.

The TSCFP has delivered various training and capacity building projects in Pakistan for enhanced due diligence and management of environmental and social issues in trade and supply chains. It will be implementing environmental and social management systems in all partner banks in Pakistan.

Microfinance Program

In 2022, the Microfinance Program (MFP) helped mobilize local currency financing of $340.6 million, including $170.3 million in cofinancing. By the end of 2022, the program had established partnerships with nine partner financial institutions and 25 active microfinance institutions (MFIs) in Bangladesh, Cambodia, India, Indonesia, Pakistan, the Philippines, and Uzbekistan.

In 2022, the program expanded coverage by onboarding five MFIs in Cambodia, India, and Uzbekistan and one new partner financial institution in Pakistan.

Through the MFP, ADB and its partners aim to address the poor access to financial services in most of ADB’s developing member countries (DMCs). Through its credit-enhancement products for wholesale lending to MFIs, ADB’s program expands the risk appetite of private financing institutions. It helps low-income micro-borrowers to access private-sector financing.

The program’s technical assistance initiatives and financing activities complement each other through (i) institutional strengthening of small and mid-sized MFIs in areas such as governance, operational controls, and credit processes; (ii) supporting the digitalization of MFI products and processes; (iii) instilling consumer protection principles and promoting the digital and financial literacy of end-borrowers; (iv) building community resilience, especially for home improvement and sanitation loans; and (v) supporting the pilot-testing of parametric microinsurance products targeted at low-income households in rural areas most vulnerable to the effects of climate change.

The MFP facilitates local currency lending to MFIs across the DMCs with a high concentration in India. It expands access to finance for micro-businesses and farm-related activities, primarily owned and/or managed by women.

Technical Assistance

Five technical assistance (TA) programs amounting to $2 million were committed in 2022. The project Accelerating Climate Finance Investments through the Financial Sector in Bangladesh andNepalsupports upstream market development work to diagnose barriers to investment in non-utility scale renewable energy and energy efficiency through financial institutions in Nepal and Bangladesh. Developing Private Sector Sustainable Transportation Opportunities in Southeast Asia facilitates climate finance business development activities related to sustainable transport investments in Indonesia, the Philippines, Thailand, and Viet Nam. Another TA approved was the Preparation of the ADB Ventures Investment Fund 2. The TA designs, sets up, and operationalizes the ADB Ventures Investment Fund 2 under the ADB Ventures Financing Partnership Facility (ADB Ventures). ADB Ventures supports and invests in early-stage technology companies that contribute to achieving the Sustainable Development Goals in emerging Asia and the Pacific. Likewise, ADB approved the TA on Women’s Financing Marketplace– Innovation and Technology (Subproject 2), which facilitates and broadens access to finance for women and women businesses.

Helping Women Business Owners Access Capital Financing

Women borrowers have an untapped commercial potential in Asia and the Pacific. There is insufficient awareness on the barriers that women or women-led or -owned businesses face when trying to access financial services. This led to the absence of targeted marketing and suitable and affordable products for women. The impacts of the COVID-19 pandemic have reinforced the importance of a digital economy to change business models into digital business models and integrate digital channels into how financial service providers or businesses engage with customers.

The technical assistance cluster, financed on a grant basis by the Women Entrepreneurs Finance Initiative for $400,000 under the Women Accelerating Vibrant Enterprises in Southeast Asia and the Pacific, works toward sustainable financial inclusion for women and women businesses by supporting the identification and design of innovative technologies and suitable and sustainable digital service delivery models to support gender-responsive ecosystems.

The fund also supports the identification of cutting-edge technology solutions for digital and gender-responsive financial service delivery in a safe environment, with a potential to commercially pilot such solutions.

Transaction Advisory Services

In 2022, ADB’s transaction advisory services (TAS) mobilized $60 million of private sector investments through public–private partnerships (PPPs).

Included are TAS for the refurbishment, operations, and maintenance of the district heating network in Tashkent City, Uzbekistan; establishment of Palau’s first utility-scale solar farm—one of the largest solar PPPs in the Pacific; and upgrade of solid waste management systems in Dili, Timor-Leste, through construction of sanitary landfill (vs. current open dump) and waste collection.

ADB continues to address infrastructure development gaps in Asia and the Pacific by developing PPP solutions. ADB’s Office of Public–Private Partnership provides advisory services for the delivery of bankable PPP projects attractive to the private sector. This includes the management of the Asia Pacific Project Preparation Facility, a multi-donor trust fund with contributions from the governments of Australia, Canada, and Japan.

Improving Public Health Through Efficient Solid Waste Management

Rapid population growth in Dili, the capital of Timor-Leste, has led to mounting concerns about the sustainability of the Tibar landfill, one of the largest open dump sites in Southeast Asia. The population of Dili municipality has grown from just 60,000 in 1960 to about 364,000 today. Urban solid waste generation has grown proportionally.

Despite daily collection, it is estimated that less than 70% of urban solid waste generated in Dili is collected. Many areas on the periphery of the municipality are unserved. The remaining waste is burned, buried, or illegally disposed of in drains or vacant spaces.

ADB provided project preparatory technical assistance to the Government of Timor-Leste to address these public health hazards through its Dili Solid Waste Management Project. The $1.2 million support under ADB’s Asia Pacific Project Preparation Facility supported the government to turn the open waste dump in Tibar into a controlled, fully equipped sanitary landfill that meets international standards, and modernize the delivery of waste collection and transportation services.

The project will collect and process around 180 tons of waste per day and is expected to improve public health and air quality, reduce greenhouse emissions, and provide local employment opportunities. This is the first public–private partnership in the waste sector and the country’s second public–private partnership project.