After the Asia and Pacific region progressed in addressing the COVID-19 pandemic, new challenges unfolded that left the region juggling economic development with emergency response. With the Russian invasion of Ukraine, worsening food crises, and disasters triggered by natural hazards adding to the stress, the necessity of working together toward growth and resilience grew stronger.

ADB partners with international development agencies, nongovernment or civil society organizations, philanthropies, multilateral and bilateral institutions, the private sector, and other emerging development partners. These financing partners provide cofinancing through contributions to projects and trust funds.

Partners keen on a strategic, long-term collaboration may agree with ADB on an indicative amount of development finance for a specific period. This financing can be divided into specific projects or trust funds. In such cases, ADB and the financing partner sign a partnership financing arrangement (PFA) to formalize and define the partnership in broad terms. The PFAs—also expressed as framework cofinancing arrangements, memoranda of understanding (MOU), and similar terms—facilitate better strategic collaboration, cooperation, and complementarity.

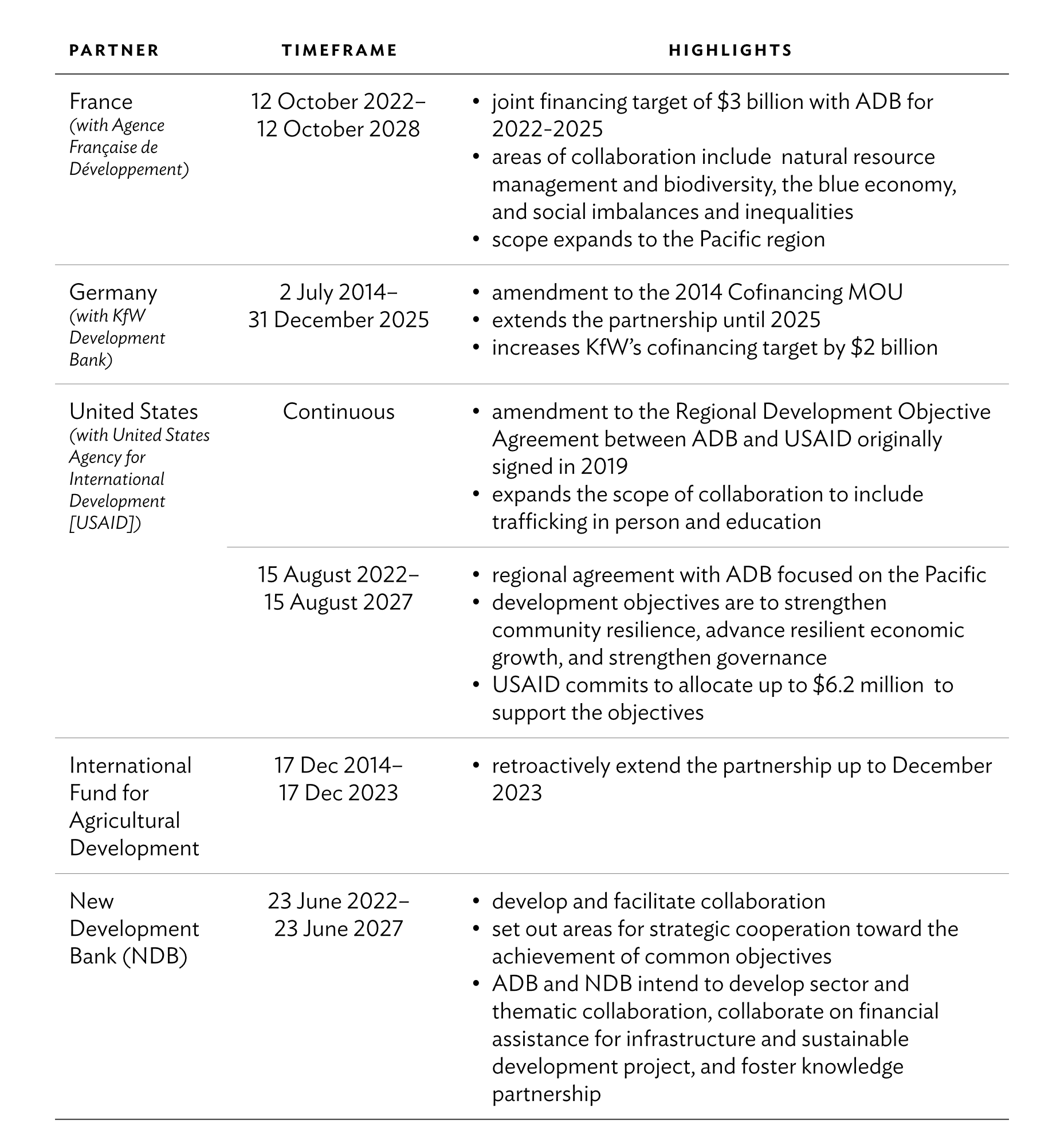

In 2022, ADB amended and renewed PFAs with the following financing partners:

In 2022, ADB worked with 14 bilateral partners, 10 multilateral partners and global funds, and numerous private sector and other partners on 124 sovereign and 41 nonsovereign projects, programs, and technical assistance (TA). It also administered 43 trust funds, including 3 newly established to support energy transition, innovative climate change projects, and project preparation, where partners can contribute and channel grants to specific countries or development themes. Bloomberg Family Foundation Inc. and Goldman Sachs Charitable Gift Fund made their first cofinancing by contributing to a trust fund that supports innovative climate change projects.

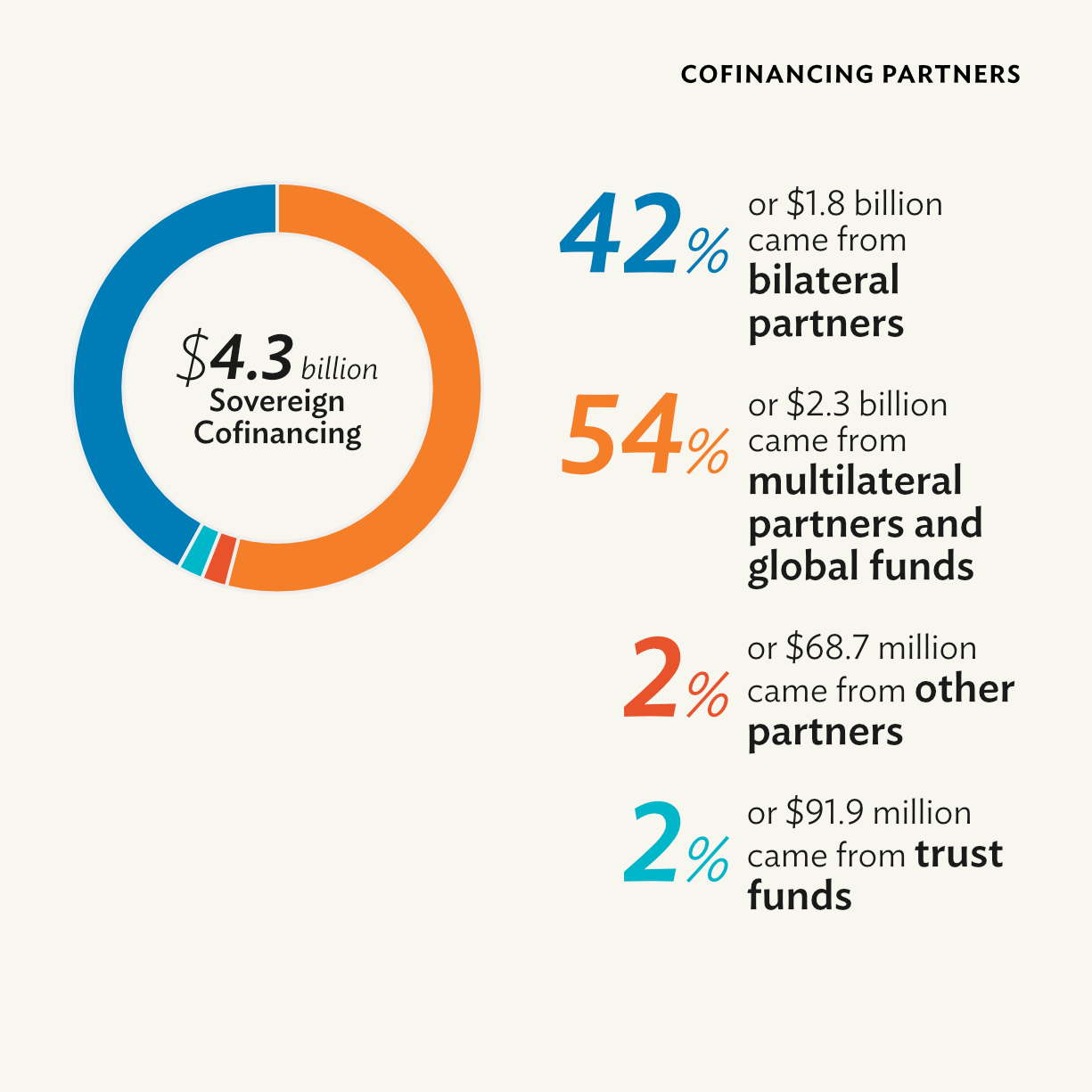

Zooming into sovereign cofinancing, bilateral partners cofinanced 28 projects and TA for a total of $1.8 billion, which accounts for 42% of the total sovereign cofinancing in 2022. Multilateral partners and global funds account for 54% with $2.3 billion for 35 projects and TA, and other partners account for 2% with $68.7 million for 3 projects. The remaining 2% of sovereign cofinancing was coursed through trust funds.

Of the $234 million grant cofinancing for 23 projects, 59% or $138.2 million came from bilateral partners. Of the $4 billion loan cofinancing for 24 projects, 56% or $2.2 billion came from multilateral partners and global funds. Of the $123.6 million grant cofinancing for 82 TAs, 56% or $69 million came from trust funds.

This section highlights the financing partners with active sovereign cofinanced projects and TA and those with contributions committed to trust funds in 2022.

Bilateral Partners

ADB works with a wide range of bilateral partners—government organizations that give direct assistance to a recipient country for development purposes—within and outside the Asia and Pacific region.

Multilateral Partners

ADB partners with organizations or institutions established or chartered by more than one country to provide financial support and professional advice for economic and social development activities in developing countries. These include the Global Funding Initiatives where the International Bank for Reconstruction and Development acts as the trustee.

Global funds leverage public or private resources to support international initiatives, enabling partners to provide a direct and coordinated response to global priorities. ADB assists developing members in gaining access to its financing.

- ASEAN Infrastructure Fund

- Asian Infrastructure Investment Bank

- Asian Investment Facility

- Climate Investment Funds

- Eurasian Development Bank

- European Bank for Reconstruction and Development

- European Investment Bank

- European Union

- Global Agriculture and Food Security Program

- Global Environment Facility

- Global Partnership for Education Fund

Other Partners

ADB works with other partners through concessional or commercial cofinancing, including partners from the private sector with corporate social responsibility and philanthropic thrusts.